Data, Fraud 5 min read

Data-driven fintech: Revolutionizing customer onboarding with AI and third-party data

The financial services landscape has undergone a significant transformation, with one clear catalyst driving change: data.

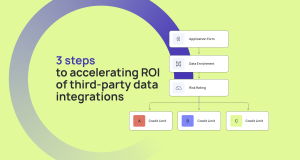

The rise of third-party data providers and advanced AI-driven data analytics tools are revolutionizing how fintech companies onboard customers. In a crowded market, the ability to efficiently onboard customers with speed and precision is essential for growth.

This article explores how the evolving financial data ecosystem enables product and risk teams to improve onboarding accuracy and unlock rapid growth in both established and untapped customer segments.

Key takeaways

- Data-driven onboarding is essential for growth and security; teams that leverage high-quality third-party data can onboard customers faster while reducing fraud risks, enabling them to scale efficiently.

- AI and machine learning transform fraud detection; real-time analysis of identity and behavioral data allows fintechs to improve onboarding accuracy and protect against increasingly sophisticated fraud tactics.

- Alternative data sources unlock new market opportunities; by using device intelligence, behavioral biometrics, and geolocation data, fintechs can accurately assess risk in segments with limited traditional sources of onboarding data.

- Automated fraud prevention enhances efficiency and compliance; integrating advanced fraud solutions streamlines the onboarding process, allowing companies to grow while maintaining high levels of security.

Customer onboarding 2.0: From static to AI-driven, dynamic solutions

The National Survey of Unbanked and Underbanked Households by the Federal Deposit Insurance Corporation (FDIC) reports that approximately 2.5 million synthetic identities exist in U.S. bank accounts. This highlights the growing complexity of fraud tactics faced by fintech companies. However, modern tools and data-driven approaches are turning these challenges into opportunities for growth.

The modern fintech ecosystem is increasingly defined by dynamic data approaches that enhance onboarding efficiency and significantly reduce fraud risks. The explosion of new data sources allows teams to leverage previously inaccessible information, enabling faster, more accurate onboarding—even in markets with minimal digital footprints.

AI-driven fraud detection and machine learning solutions have emerged as essential tools in this transformation. Yigit Yildirim, SVP of Data & AI at Socure, describes the shift:

"The fraud prevention landscape has undergone a revolutionary shift, moving from fragmented, static systems to a unified, real-time approach that offers a comprehensive view of customer identity. At Socure, we’ve spearheaded this transformation by developing a centralized platform that instantly consolidates and analyzes identity data from multiple touchpoints. This holistic, AI-driven solution not only dramatically reduces risk for businesses but also enables smoother, faster onboarding experiences for consumers, setting new standards for trust and efficiency in the digital economy."

By aggregating and analyzing data from various sources in real time, these platforms reduce fraud risks while providing a seamless experience for legitimate customers. Real-time fraud scoring ensures that fintech companies can onboard legitimate customers quickly while stopping potential fraudsters in their tracks.

Improving onboarding precision through alternative data sources

For fintech companies operating in emerging markets or in segments with limited traditional onboarding data, accurately and safely onboarding new customers has been a persistent challenge. However, the use of alternative data sources—such as device intelligence, behavioral biometrics, and geolocation data—allows teams to assess risk effectively, even in these environments.

Multi-layered authentication and continuous monitoring are key to this success. Behavioral analytics, which examines patterns such as typing speed and navigation habits, provides deep insights into user authenticity and intent. These insights enable fintechs to detect fraudulent activity before it occurs.

For business customers, the evolution of KYB and fraud solutions has opened new possibilities for financial service providers. Companies can now leverage data from accounting software, payment processors, and industry-specific platforms to verify the legitimacy of new business customers in real time. As Jonathan Awad, CEO and Founder of Baselayer, explains:

"In a competitive business banking/lending environment, and with limited room to staff large teams to handle manual reviews, you want a solution that will convert more good leads, and do so automatically. Baselayer verifies 100% of registered businesses and creates a comprehensive business profile that looks at compliance and risk factors."

By integrating advanced fraud prevention tools, businesses not only protect themselves from fraudulent entities but also accelerate their onboarding processes. Teams that adopt these cutting-edge solutions gain a competitive edge by expanding into new markets more rapidly while maintaining a high level of security and compliance.

The payoff: Reduced fraud, faster growth

Fintech companies that embrace data-driven onboarding solutions are already seeing measurable results. Socure’s platform, for example, helped one leading digital bank significantly improve its approval rates, increasing automatic verification from 79% to 92% overall and from 66% to 84% in one of its largest portfolios. This implementation also led to a 54% reduction in identity fraud losses, generating a $24 million annual increase in value for a single business unit—delivering a 19.3x return on investment.

These examples demonstrate the enormous potential for fintech companies to optimize their onboarding processes through innovative data strategies. In today's rapidly evolving digital economy, the ability to onboard customers faster and more securely is no longer optional—it is essential for sustainable growth.

Unlock the power of third-party data in fintech decisions

The financial data revolution is transforming the way fintech companies onboard customers, enabling faster, more accurate onboarding while minimizing fraud risks. By adopting AI-driven fraud detection tools and leveraging alternative data, companies can achieve both security and growth, expanding into new markets with confidence.

To learn more about how to unlock the value of third-party data in your fintech decisions, download our comprehensive guide: Rebalancing Risk & Reward: The Ultimate Guide to Leveraging Third-Party Data in Fintech Decisions.