B2B, Case Study 3 min read

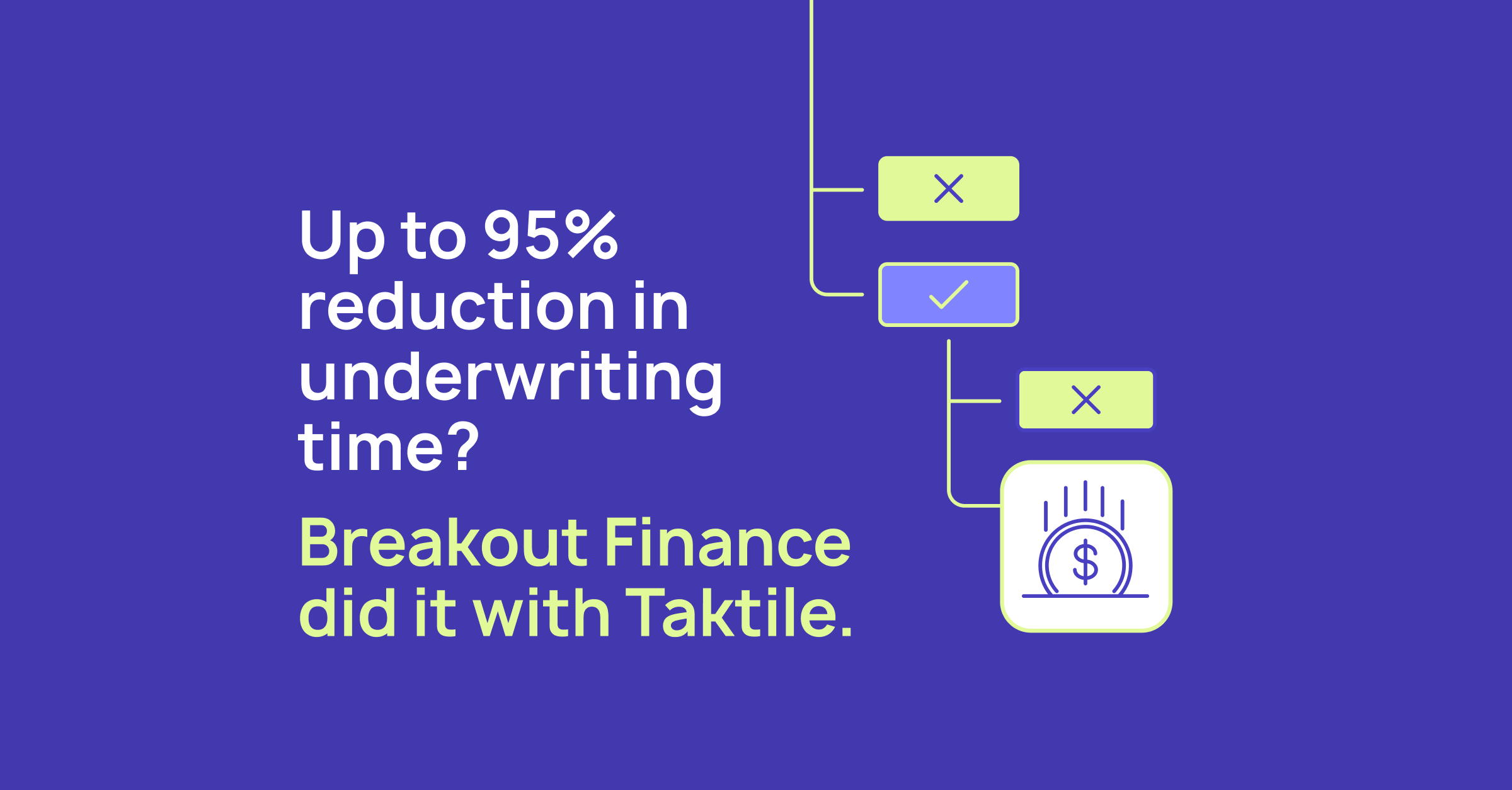

How Breakout Finance cut underwriting time by up to 95% with Taktile

Key takeaways

Breakout Finance, a US-based alternative lender, needed to scale its credit underwriting operations efficiently without compromising accuracy. By implementing Taktile’s next-generation decision platform, they achieved:

- Up to 95% reduction in underwriting time, from 1 hour to as little as 3 minutes per decision.

- Capacity for a 3-5x increase in application processing, positioning them to handle higher volumes and respond to top-of-funnel leads more efficiently.

- Full integration with Salesforce and Baselayer, ensuring seamless data flows between internal and external data sources and improved decision-making.

These advancements have allowed Breakout Finance to significantly expand its underwriting capacity, maintain a lean underwriting team, and remain competitive in the fast-paced US lending market.

Meet Breakout Finance: A B2B financing company on a simple yet powerful mission

Since its founding in 2010, Breakout Finance has focused on providing tailored financial solutions to support the growth of small businesses across the United States. Offering a range of options—working capital term loans, invoice factoring, asset-based loans, and purchase order financing—Breakout has delivered nearly $1 billion in funding to date, always aiming to meet the unique needs of its clients.

The opportunity: Fast, safe, and scalable capital deployment

Breakout Finance had a significant opportunity ahead of them—to deploy a large amount of new capital and scale quickly in the competitive lending market. However, their existing underwriting process, bogged down by manual workflows, was unable to keep up with the pace required. Even straightforward loan applications were taking over an hour to process, creating a significant bottleneck.

“For the number of loans and amount of capital we wanted to deploy, our existing process was too slow to keep up with the pace we wanted,” says Ian Bradley, Head of Operations and Technology at Breakout Finance.

The challenge was not finding more leads—it was handling the existing lead volume quickly and accurately. Breakout needed a solution that would automate elements of decision-making while maintaining the high level of precision and guardrails required.

The innovation: A next-generation platform for seamless automation and integrations

After learning about Taktile's decision platform from industry peers and exploring it through a tailored demo, Ian quickly realized that Taktile’s modular, flexible design was the perfect fit for Breakout Finance’s use cases of onboarding/KYB/C and credit underwriting.

As Ian puts it: “Why build something from scratch when I can buy the best-in-class solution?”

Taktile empowers Breakout’s underwriters to take complete control of the underwriting process. With tools to build, run, experiment, and monitor decisions independently, underwriters can test new decision models and instantly integrate data from their internal systems and preferred third-party providers. This flexibility allowed Breakout to automate previously time-consuming tasks, freeing up their team to focus on higher-value decision-making tasks.

Ian emphasizes the critical role of flexibility when automating decisions across multiple use cases:

“You need software with the flexibility to ingest inputs from various sources simultaneously—that’s what gives you the real advantage in underwriting.”

Taktile’s ready-to-use integration with Salesforce was particularly valuable.

“All underwriting data is now seamlessly connected to our Salesforce, providing us a holistic view of customer data and decision history,” Ian adds.

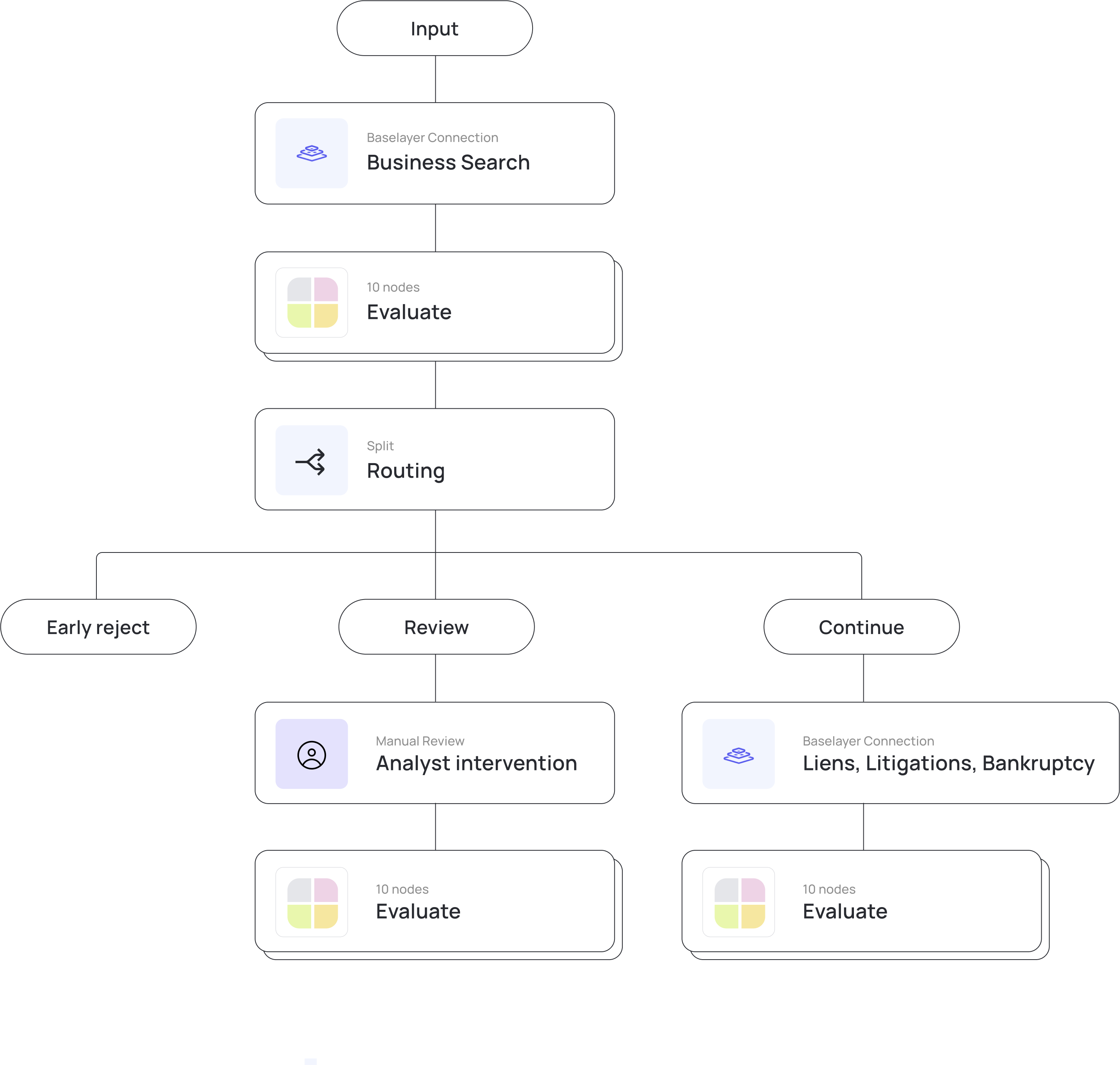

In addition, Ian utilized Taktile’s Baselayer integration template to automatically enhance their risk assessments. With built-in, adaptable logic, the template was easily customized to align with Breakout's specific needs.

Furthermore, Breakout’s team now has the ability to swap out and experiment with new integrations with minimal downtime and comprehensive documentation that tracks every change. Ian puts it simply:

“Taktile’s seamless integrations and solid documentation give us the confidence to experiment, knowing we can always roll back if necessary.”

The outcome: Up to 95% reduction in underwriting time and 5x increase in ability to process applications

“The partnership with Taktile has been essential to Breakout—and it goes far beyond the software,” Ian says. “Taktile’s innovation and speed are truly impressive. They've consistently kept our end goals in mind, and every single team member I’ve worked with has been highly skilled. That level of expertise is rare in a software company.”

From an underwriting standpoint, Breakout Finance has transformed its operations since implementing Taktile:

- Up to 95% reduction in underwriting time: Before Taktile, underwriting decisions could take over an hour and, in some cases, up to 4 hours. Now, they take as little as 3 minutes, even in the most complex cases.

- 3-5x increase in application processing capacity: With streamlined, rapid processing, Breakout Finance now has the capability to handle a substantially higher volume of new loan applications, supporting increased top-of-funnel conversion potential from marketing initiatives.

- Rapid integration deployment with pre-built templates: By leveraging a pre-built, optimized Baselayer template through Taktile, Breakout was able to go from testing to live in production in just one day—a process that previously took over a week now takes only a few hours.

- A unified data ecosystem: With critical integrations to Salesforce and Baselayer, Breakout can now manage customer relationships and underwriting data more efficiently, reducing blind spots and improving decision accuracy.

“Taktile has allowed us to stop worrying about ‘how’ to get things done and instead focus on ‘how much’ we can achieve,” says Bradley. “It's been a significant accelerator for our business.”

With Taktile as a strategic partner, Breakout Finance is poised for continued growth. The automation and integrations provided by Taktile have given the team the confidence to pursue aggressive expansion targets while ensuring the precision and reliability that underpin their lending decisions.