Lending, Insights 3 min read

Taktile’s State of Lending report reveals how lenders plan to grow more profitably in 2023

Key takeaways

Inflation reduction measures lead to a laser focus on profitability, but growth remains important

The most agile lenders are the closest to achieving their performance goals

The majority of lenders are held back by rigid credit decision infrastructures

Lenders are motivated to invest in their credit decision infrastructure capabilities to empower their credit teams

Outlook for the lending industry remains promising, despite a challenging economic environment

The current high-interest rate environment has caused a shift in the lending industry, which has taken many fintechs into unfamiliar territory. As a result, fintechs have had to shift their approach to lending as they rebalance their strategic priorities to grow more profitably.

Today, we launched our first State of Lending Report, uncovering how lenders are adapting to this new economic landscape.

Based on a global survey of risk teams and credit experts, we explore how recent macroeconomic changes flow through to lending operations and reveal how lenders are adjusting their business strategies to achieve both growth and profitability in 2023.

Key takeaways

- Inflation reduction measures have led to lenders prioritizing profitability this year, as rising interest rates have had a significant impact on their return on capital.

- Lenders with agile credit decision solutions are closer to achieving their performance goals. However, the average lender lacks this kind of agility due to rigid credit decision infrastructures that require heavy engineering support.

- To become more agile, lenders are motivated to improve their credit decision infrastructures to empower their credit teams to quickly optimize credit policies in a data-driven way.

- With a high borrower demand for lending products, and an increased availability of advanced credit decision-making tools, the future of lending is promising.

Inflation reduction measures lead to a laser focus on profitability, but growth remains important

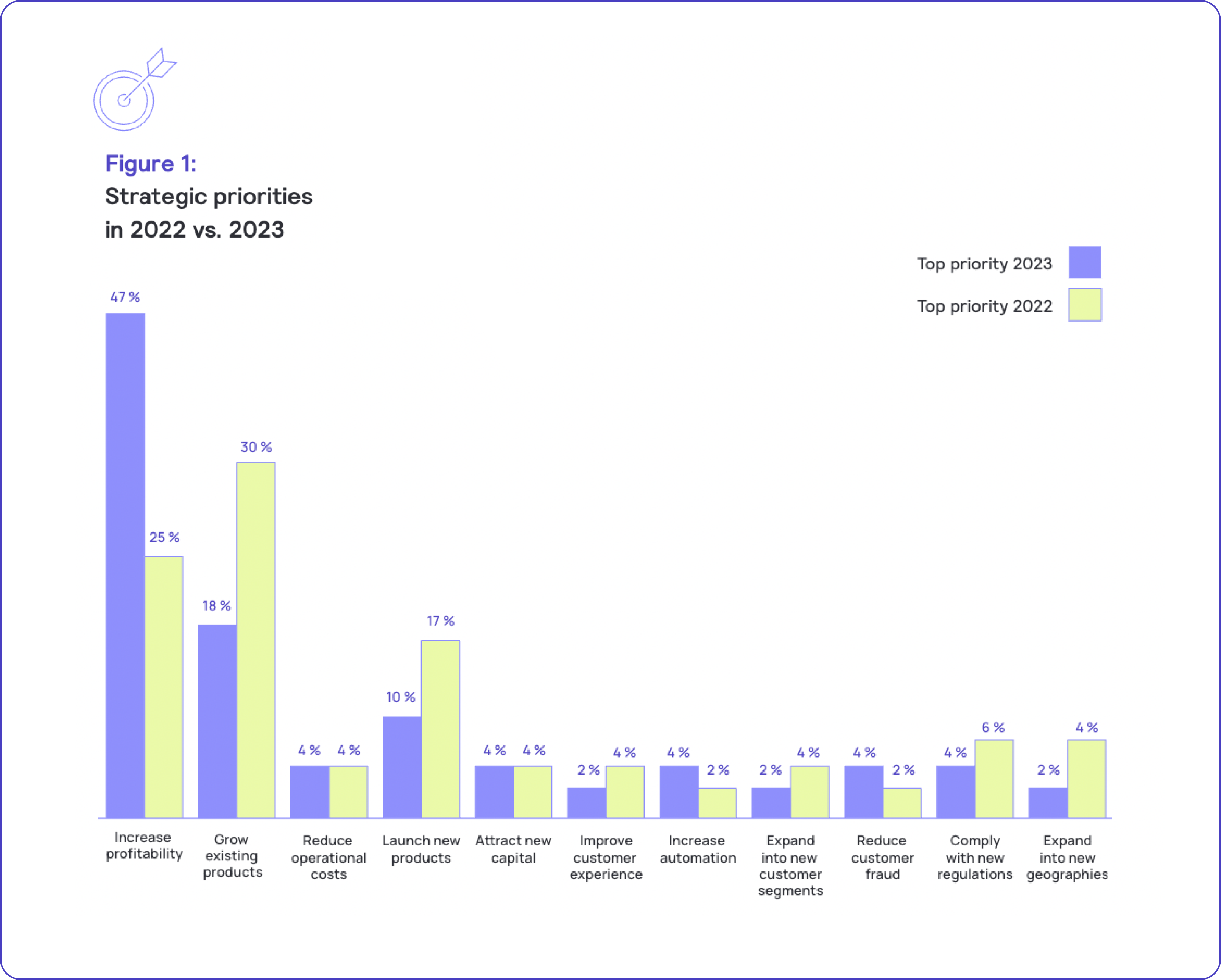

The interest rate hikes put in place by central banks to curb inflation quickly impacted the profitability of lending operations. Survey results reveal that over two-thirds of lenders have been negatively affected by the rising capital costs, leading to a squeeze on their return on capital.

As a result, increasing profitability has become paramount for lenders, with almost half of survey respondents identifying this as their top strategic priority this year.

Nevertheless, many lenders still plan to pursue growth, particularly in emerging markets like Africa, where huge growth potential remains for financial products.

But how do lenders plan to grow while increasing the profitability of their operations?

Survey results indicate that lenders are highly motivated to optimize several key performance indicators. Almost half of survey respondents plan to increase their customer conversion rates by over 5 percentage points (p.p.), and over a third want to reduce their customer default rate by more than 5 p.p.

Download the full report to gain insight into the key levers lenders are pulling to drive profitable growth.

The most agile lenders are the closest to achieving their performance goals

While many respondents are finding it difficult to adapt their business models, top-performing lenders reveal some impressive best practices.

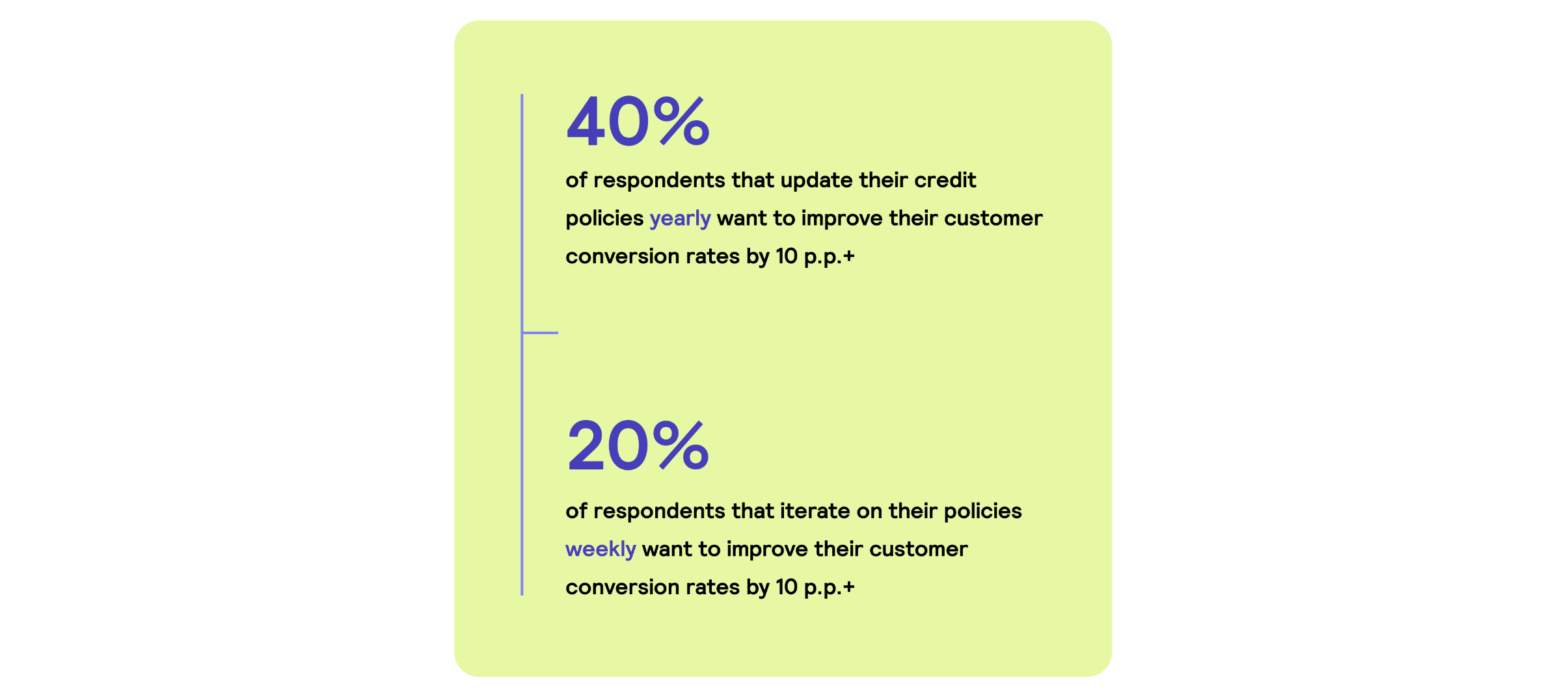

According to survey results, lenders with the most agile approach to their credit decisions are the closest to achieving their performance goals in 2023. They are constantly optimizing their credit policies and are doing so with speed.

The majority of lenders are held back by rigid credit decision infrastructures

Although a select group of lenders have cracked the code and are quick to adjust their credit policies to achieve their performance goals, most lenders lack this level of agility.

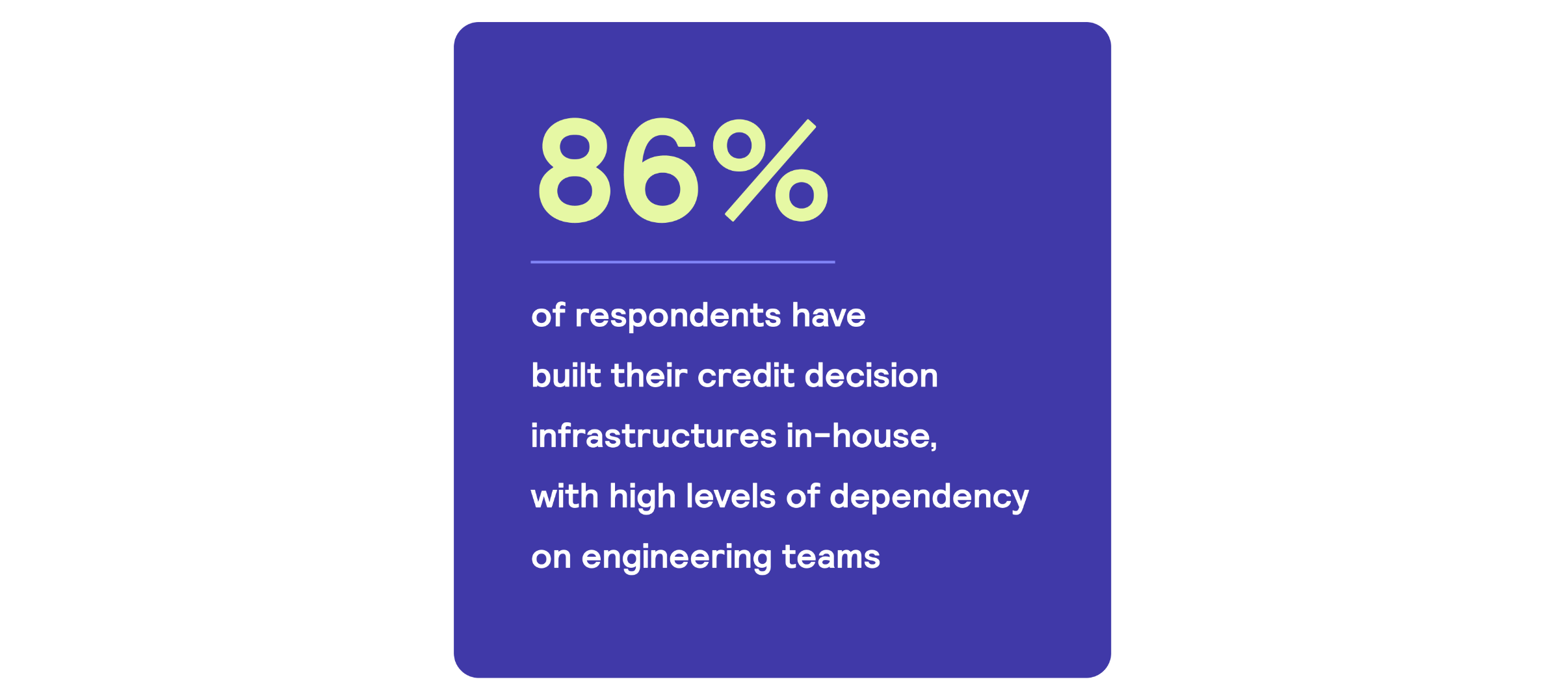

The majority of survey respondents report that they face significant challenges with their credit decision infrastructures that prevent their credit teams from optimizing their policies in an agile way.

Respondents report that integrating new data sources, building and deploying predictive models, and achieving the right degree of automation is particularly difficult.

To perform these activities, the average lender currently requires a lot of technical engineering resources, meaning changes to credit policies are slow. At the moment, 75% of lenders cannot integrate new data sources into their credit decisions without the help of engineers.

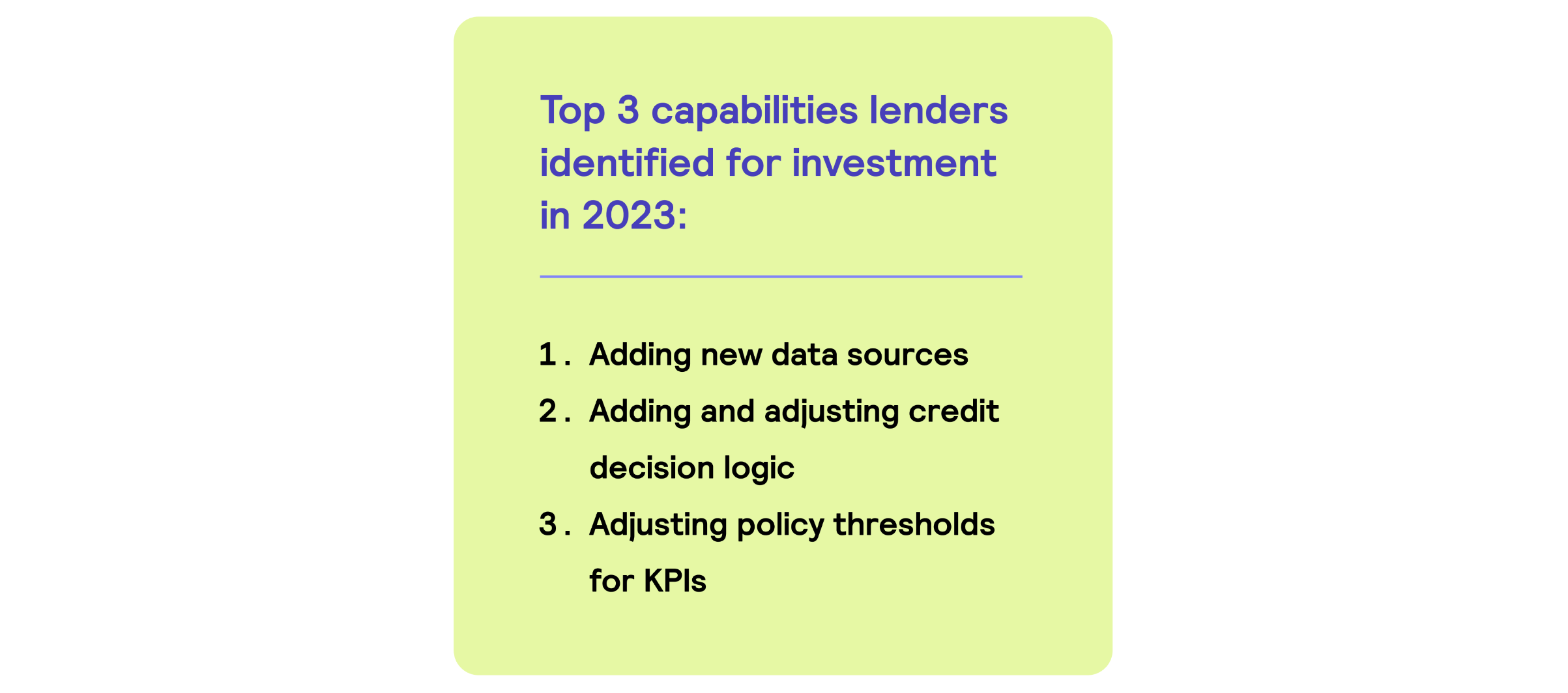

Lenders are motivated to invest in their credit decision infrastructure capabilities to empower their credit teams

Given these challenges, many lenders recognize the need to achieve faster, more frequent policy iteration – and hope to do so by enabling their credit teams to self-serve so they can rely less on technical teams.

Download the full report to discover how lenders plan to empower their credit teams to position themselves on the path to profitability.

Outlook for the lending industry remains promising, despite a challenging economic environment

Despite economic volatility, 84% of lenders are optimistic about the future of the lending industry. And customer demand for lending products remains high, with 42% of respondents indicating that the current interest rate environment has positively impacted borrower demand.

The lending industry has undoubtedly entered a new era – but with the rise of advanced credit decision tools and strong demand for new lending products, lenders have an unprecedented opportunity to adapt and prosper in the new status quo.