AI agents you can trust.

Taktile's Agentic Decision Platform combines the speed of AI automation with the oversight of human judgement - so you can safely approve customers, catch more fraud, and stay compliant.

Discover Taktile

Trusted by leading financial institutions worldwide.

Move from vision to value in weeks, not months.

Quickly unlock AI-driven efficiencies across the customer lifecycle — reducing manual work, strengthening decision-making, and improving end-user experiences.

Powering transformation for the world’s most ambitious financial institutions.

“With Taktile, we can rapidly evolve our credit strategy, streamline operations, and strengthen risk controls — enabling better credit experiences for thousands of customers and freeing our credit team from hours of manual work.”

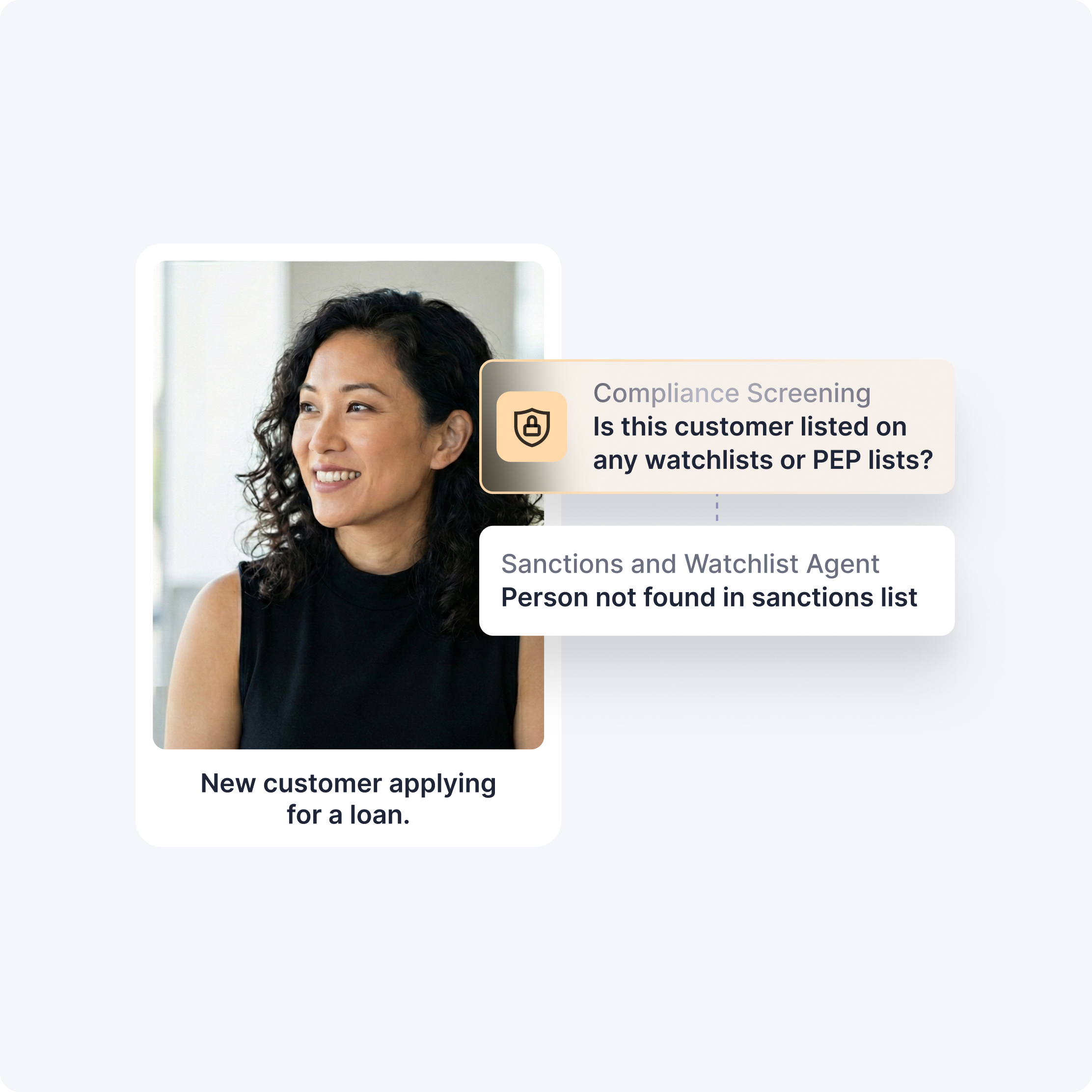

AI, rules, and human judgement,

safely orchestrated on one trusted platform.

Built for the complexity of financial services, Taktile gives you the tools to design and control how artificial intelligence, business logic, and human judgment interact — ensuring every AI-driven decision aligns with your policies and governance standards.

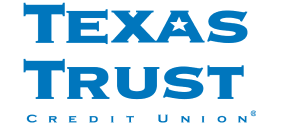

Leverage specialist AI agents. Designed by industry experts to replace manual, repetitive work, Taktile's agents help you make better decisions, faster.

Deploy end-to-end solutions. Taktile’s configurable solutions help you roll out new automated decision strategies with speed and confidence.

Set clear guardrails. Configure how agents operate according to your rules and processes, ensuring decisions reflect your business requirements.

Verify every outcome. See the full chain of reasoning behind every output, with traceability and validation at every step.

Monitor performance. Understand how your strategies perform across the customer lifecycle with real-time analytics that reveal what’s working, what’s changing, and where to focus for the highest impact.

Tune continuously. Keep evolving thresholds, workflows, and human touch points to keep agent performance aligned with your goals and responsive to evolving conditions.

Good decisions

need good data.

Connect to best-in-class third-party providers and quickly adapt your data stack without vendor lock-in or long integrations.

Equifax

Equifax  Anthropic

Anthropic  Codat

Codat  ThomsonReuters

ThomsonReuters  MongoDB

MongoDB  Experian

Experian  Slack

Slack  Socure

Socure  Creditsafe

Creditsafe  Middesk

Middesk  BigQuery

BigQuery  OpenAI

OpenAI  CRIF

CRIF  LexisNexis

LexisNexis  Opensanctions

Opensanctions  TransUnion

TransUnion  Dun & Bradstreet

Dun & Bradstreet  Snowflake

Snowflake  Plaid

Plaid  Fingerprint

Fingerprint  Equifax

Equifax  Anthropic

Anthropic  Codat

Codat  ThomsonReuters

ThomsonReuters  MongoDB

MongoDB  Experian

Experian  Slack

Slack  Socure

Socure  Creditsafe

Creditsafe  Middesk

Middesk  BigQuery

BigQuery  OpenAI

OpenAI  CRIF

CRIF  LexisNexis

LexisNexis  Opensanctions

Opensanctions  TransUnion

TransUnion  Dun & Bradstreet

Dun & Bradstreet  Snowflake

Snowflake  Plaid

Plaid  Fingerprint

Fingerprint  Equifax

Equifax  Anthropic

Anthropic  Codat

Codat  ThomsonReuters

ThomsonReuters  MongoDB

MongoDB  Experian

Experian  Slack

Slack  Socure

Socure  Creditsafe

Creditsafe  Middesk

Middesk  BigQuery

BigQuery  OpenAI

OpenAI  CRIF

CRIF  LexisNexis

LexisNexis  Opensanctions

Opensanctions  TransUnion

TransUnion  Dun & Bradstreet

Dun & Bradstreet  Snowflake

Snowflake  Plaid

Plaid  Fingerprint

Fingerprint  Equifax

Equifax  Anthropic

Anthropic  Codat

Codat  ThomsonReuters

ThomsonReuters  MongoDB

MongoDB  Experian

Experian  Slack

Slack  Socure

Socure  Creditsafe

Creditsafe  Middesk

Middesk  BigQuery

BigQuery  OpenAI

OpenAI  CRIF

CRIF  LexisNexis

LexisNexis  Opensanctions

Opensanctions  TransUnion

TransUnion  Dun & Bradstreet

Dun & Bradstreet  Snowflake

Snowflake  Plaid

Plaid  Fingerprint

Fingerprint  Equifax

Equifax  Anthropic

Anthropic  Codat

Codat  ThomsonReuters

ThomsonReuters  MongoDB

MongoDB  Experian

Experian  Slack

Slack  Socure

Socure  Creditsafe

Creditsafe  Middesk

Middesk  BigQuery

BigQuery  OpenAI

OpenAI  CRIF

CRIF  LexisNexis

LexisNexis  Opensanctions

Opensanctions  TransUnion

TransUnion  Dun & Bradstreet

Dun & Bradstreet  Snowflake

Snowflake  Plaid

Plaid  Fingerprint

Fingerprint  Codat

Codat  Snowflake

Snowflake  TransUnion

TransUnion  Plaid

Plaid  Middesk

Middesk  LexisNexis

LexisNexis  Fingerprint

Fingerprint  Equifax

Equifax  OpenAI

OpenAI  Opensanctions

Opensanctions  Anthropic

Anthropic  ThomsonReuters

ThomsonReuters  Creditsafe

Creditsafe  BigQuery

BigQuery  MongoDB

MongoDB  Socure

Socure  Experian

Experian  CRIF

CRIF  Dun & Bradstreet

Dun & Bradstreet  Slack

Slack  Codat

Codat  Snowflake

Snowflake  TransUnion

TransUnion  Plaid

Plaid  Middesk

Middesk  LexisNexis

LexisNexis  Fingerprint

Fingerprint  Equifax

Equifax  OpenAI

OpenAI  Opensanctions

Opensanctions  Anthropic

Anthropic  ThomsonReuters

ThomsonReuters  Creditsafe

Creditsafe  BigQuery

BigQuery  MongoDB

MongoDB  Socure

Socure  Experian

Experian  CRIF

CRIF  Dun & Bradstreet

Dun & Bradstreet  Slack

Slack  Codat

Codat  Snowflake

Snowflake  TransUnion

TransUnion  Plaid

Plaid  Middesk

Middesk  LexisNexis

LexisNexis  Fingerprint

Fingerprint  Equifax

Equifax  OpenAI

OpenAI  Opensanctions

Opensanctions  Anthropic

Anthropic  ThomsonReuters

ThomsonReuters  Creditsafe

Creditsafe  BigQuery

BigQuery  MongoDB

MongoDB  Socure

Socure  Experian

Experian  CRIF

CRIF  Dun & Bradstreet

Dun & Bradstreet  Slack

Slack  Codat

Codat  Snowflake

Snowflake  TransUnion

TransUnion  Plaid

Plaid  Middesk

Middesk  LexisNexis

LexisNexis  Fingerprint

Fingerprint  Equifax

Equifax  OpenAI

OpenAI  Opensanctions

Opensanctions  Anthropic

Anthropic  ThomsonReuters

ThomsonReuters  Creditsafe

Creditsafe  BigQuery

BigQuery  MongoDB

MongoDB  Socure

Socure  Experian

Experian  CRIF

CRIF  Dun & Bradstreet

Dun & Bradstreet  Slack

Slack  Codat

Codat  Snowflake

Snowflake  TransUnion

TransUnion  Plaid

Plaid  Middesk

Middesk  LexisNexis

LexisNexis  Fingerprint

Fingerprint  Equifax

Equifax  OpenAI

OpenAI  Opensanctions

Opensanctions  Anthropic

Anthropic  ThomsonReuters

ThomsonReuters  Creditsafe

Creditsafe  BigQuery

BigQuery  MongoDB

MongoDB  Socure

Socure  Experian

Experian  CRIF

CRIF  Dun & Bradstreet

Dun & Bradstreet  Slack

Slack  Fingerprint

Fingerprint  Experian

Experian  Codat

Codat  OpenAI

OpenAI  Anthropic

Anthropic  LexisNexis

LexisNexis  Creditsafe

Creditsafe  Opensanctions

Opensanctions  ThomsonReuters

ThomsonReuters  Middesk

Middesk  BigQuery

BigQuery  TransUnion

TransUnion  Equifax

Equifax  Snowflake

Snowflake  Dun & Bradstreet

Dun & Bradstreet  CRIF

CRIF  MongoDB

MongoDB  Slack

Slack  Socure

Socure  Plaid

Plaid  Fingerprint

Fingerprint  Experian

Experian  Codat

Codat  OpenAI

OpenAI  Anthropic

Anthropic  LexisNexis

LexisNexis  Creditsafe

Creditsafe  Opensanctions

Opensanctions  ThomsonReuters

ThomsonReuters  Middesk

Middesk  BigQuery

BigQuery  TransUnion

TransUnion  Equifax

Equifax  Snowflake

Snowflake  Dun & Bradstreet

Dun & Bradstreet  CRIF

CRIF  MongoDB

MongoDB  Slack

Slack  Socure

Socure  Plaid

Plaid  Fingerprint

Fingerprint  Experian

Experian  Codat

Codat  OpenAI

OpenAI  Anthropic

Anthropic  LexisNexis

LexisNexis  Creditsafe

Creditsafe  Opensanctions

Opensanctions  ThomsonReuters

ThomsonReuters  Middesk

Middesk  BigQuery

BigQuery  TransUnion

TransUnion  Equifax

Equifax  Snowflake

Snowflake  Dun & Bradstreet

Dun & Bradstreet  CRIF

CRIF  MongoDB

MongoDB  Slack

Slack  Socure

Socure  Plaid

Plaid  Fingerprint

Fingerprint  Experian

Experian  Codat

Codat  OpenAI

OpenAI  Anthropic

Anthropic  LexisNexis

LexisNexis  Creditsafe

Creditsafe  Opensanctions

Opensanctions  ThomsonReuters

ThomsonReuters  Middesk

Middesk  BigQuery

BigQuery  TransUnion

TransUnion  Equifax

Equifax  Snowflake

Snowflake  Dun & Bradstreet

Dun & Bradstreet  CRIF

CRIF  MongoDB

MongoDB  Slack

Slack  Socure

Socure  Plaid

Plaid  Fingerprint

Fingerprint  Experian

Experian  Codat

Codat  OpenAI

OpenAI  Anthropic

Anthropic  LexisNexis

LexisNexis  Creditsafe

Creditsafe  Opensanctions

Opensanctions  ThomsonReuters

ThomsonReuters  Middesk

Middesk  BigQuery

BigQuery  TransUnion

TransUnion  Equifax

Equifax  Snowflake

Snowflake  Dun & Bradstreet

Dun & Bradstreet  CRIF

CRIF  MongoDB

MongoDB  Slack

Slack  Socure

Socure  Plaid

Plaid Navigate AI in financial

services with Taktile.

Explore Taktile's latest hands-on frameworks, operator stories, and practical AI insights.

Born in the cloud and ready for regulated industries, Taktile offers security, reliability, and scalability without the overhead.

See why financial services organizations trust Taktile to transform their businesses with unmatched safety and control.

Join Taktile Co-Founder Maximilian Eber for the live webinar unveiling our new AI agents for customer onboarding.

Discover Taktile